This article was contributed by Tom Beck of Portfolio Wealth Global.

Today’s letter is all about UNPACKING and processing together the tremendous rally we’ve seen. Let’s go through the evidence and DISCOVER just how insane this has been.

Looking both at historical data and short-term technical analysis, IT LOOKS GRIM so I want to ROLL OUT the graphs.

Courtesy: Zerohedge.com

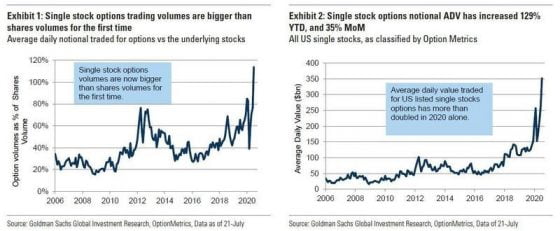

Many of you look at this data and CHOOSE TO brush it off, but I wouldn’t, because what it means is that the RETAIL PUBLIC, which has an average holding period for stocks that is measured in hours and days (since they have NO IDEA what they’re doing), is SUPER-ACTIVE.

They’re out there trading options, a game with an 88% probability of losing one’s capital.

WHERE DID THIS CONFIDENCE ORIGINATE FROM?

- The S&P 500 set a 52-week high for a week straight.

- This has never happened before, but the VOLUME OF OPTIONS is more than the volume of stocks that traded in the month of July!

In other words, there is NOTHING SUSTAINABLE about what we’re seeing!

It’s also VERY CONFUSING for stock pickers, since out of over 3,000 NYSE companies, only about 40 are at 52-week highs, while the indices themselves are CELEBRATING RECORDS.

- The Volatility index (VIX) has not breathed a sigh of relief throughout this rally, so I’m telling you – there’s SOMETHING REALLY WRONG about this rally in stocks.

It’s NOT NORMAL for stocks to trade higher into new highs, with the VIX rising in tandem. It only occurs before MAJOR SELL-OFFS.

Courtesy: Zerohedge.com, Crescat Capital LLC (good graphs)

As you can see, we’re actually back to TURN-OF-THE-CENTURY undervaluation!

The case is clear as day and the potential is quite astonishing.

Bottom line is that in the traditional markets, there are VERY FEW companies that are still attractive. You’ll notice that Buffett is now buying JAPANESE COMPANIES!

Say what you want, but I find it astonishing that the man who believed in America for 90 years can’t find a single good investment to make, apart from Barrick Gold and Japanese businesses!

Gold is where IT’S AT.

Wait for it to go past $2,000/ounce again and wait for those earnings from the mining giants; I think we have a GREAT FUTURE ahead of us!

0 Comments