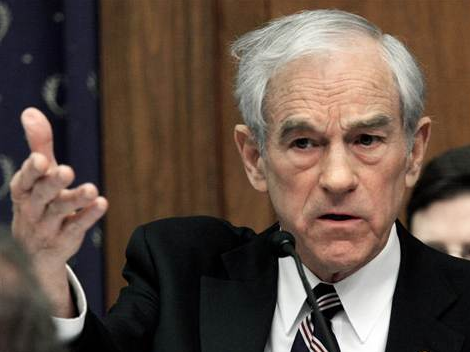

A former congressman from Texas, Dr. Ron Paul, says that the United States won’t be the exception when negative interest rates crush the economy. Dr. Paul is warning negative interest rates are coming, and the Federal Reserve cannot stop it.

“We will join the rest of them and go to total negative rates in hopes that that will be the solution,” Dr. Paul told CNBC’s “Futures Now” on Thursday. “We’ve never had as many currencies in negative interest rates. $17 trillion worth of bonds [are] in negative interest rates. It’s never existed before. And, that’s a bubble. So, we’re in the biggest bond bubble in history, and it’s going to burst.”

Dr. Paul, who is a former presidential candidate and vocal libertarian is well-known for his economic and stock market bubble warnings as well as his stance on small or non-existent government. He says that the Federal Reserve’s policies are powerless in this current bubble environment and that this week’s Fed meeting will not provide any kind of relief to Americans. He also says cutting interest rates again will not be the answer.

“You can’t predict exactly where the creation of credit goes,” said Dr. Paul. “We have a ton of inflation with all that QE [quantitative easing]. And, every time you lower interest rates below market levels and create new credit, that’s a bubble.”

Dr. Paul admits that it’s impossible to predict when the markets will collapse and the bubbles will all burst. “You don’t know this precise time. But you know it can happen,” he said. “How do you sell a bond that pays a negative rate? Who’s going to jump up and down?”

https://www.shtfplan.com/headline-news/a-worldwide-depression-is-coming-central-banks-always-cause-depressions_05152018

And the U.S. is only going to be protected from an economic depression temporarily. The stock market will only insulate for so long before it’ll take hits too. Dr. Paul says central banks, which drastically lower interest rates destroy the pricing mechanism in financial markets, can’t stop the ultimate collapse.

“I don’t think anything even existed coming close to what we’re facing today,” Paul said.

Dr. Ron Paul is the author of the book, End The Fed

. This book is a provocative and controversial treatise that argues we cannot actually fix the broken economy without discussing the 800-lb gorilla in the room: the Federal Reserve.

Most people think of the Fed as an indispensable institution without which the country’s economy could not properly function. But in End the Fed, Ron Paul draws on American history, economics, and fascinating stories from his own long political life to argue that the Fed is both corrupt and unconstitutional. It is inflating currency today at nearly a Weimar or Zimbabwe level, a practice that threatens to put us into an inflationary depression where $100 bills are worthless. What most people don’t realize is that the Fed — created by the Morgans and Rockefellers at a private club off the coast of Georgia — is actually working against their own personal interests. Congressman Paul’s urgent appeal to all citizens and officials tells us where we went wrong and what we need to do fix America’s economic policy for future generations.

0 Comments