Goldman Sachs executive Gary Cohn says we could see so much oil, there would be no way to physically store it all, resulting in falling prices, at least in certain locational areas.

Further destabilization across the globe could, logically, follow.

Cohn told Bloomberg News:

“I think the oil market is trying to figure out an equilibrium price. The danger here, as we try and find an equilibrium price, at some point

we may end up in a situation where storage capacity gets very, very limited. We may have too much physical oil for the available storage in certain locations. And it may be a locational issue.”“And you may just see lots of oil in certain locations around the world where oil will have to price to such a cheap discount vis-a-vis the forward price that you make second tier, and third tier and fourth tier storage available.”

[…] “You could see the price fall relatively quickly to make that storage work in the market.”

And though prices have recently rebounded a bit, that could well mean prices below the $50 per barrel low point that has already shaken the foundation of the geopolitical structure, sending the ruble and other currencies into chaos while threatening new drilling operations and job bases in the United States.

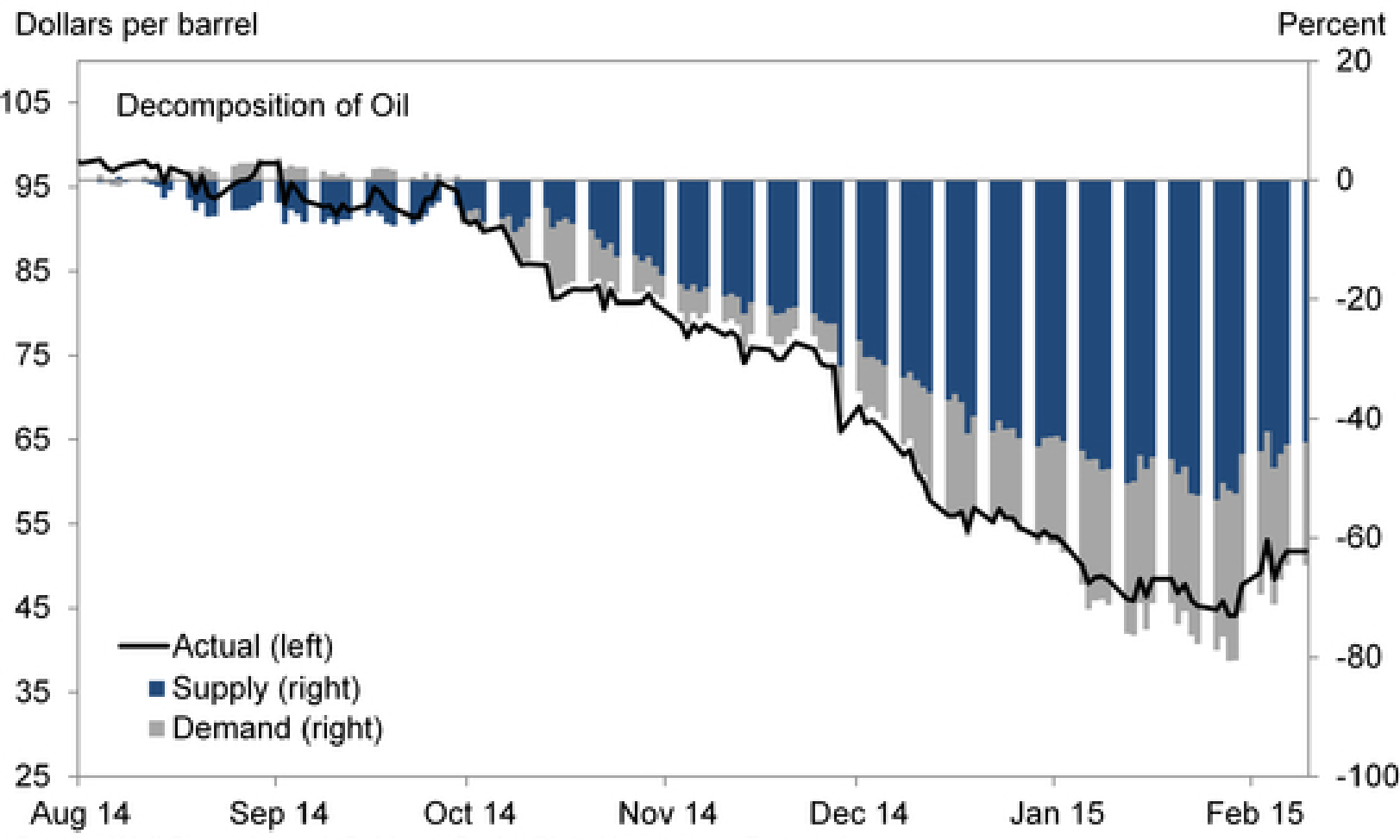

The big culprit in the oil crash has been an abundance of oil flooding the market. A massive supply shock in the second half of last year accounted for most of the decline. In December and January, slowing demand contributed to the continued sell-off. Goldman was able to quantify these effects.

The big take-away: “[T]he decline in oil has been driven by an oversupplied global oil market,” wrote Goldman economist Sven Jari Stehn. As a result, “the new equilibrium price of oil will likely be much lower than over the past decade.”

Here’s a chart to put it into pictures:

So much for peak oil, sold to the public since at least the 1970s to justify tighter supply controls and soaring prices.

Today, it is revealed as something much closer to economic warfare between competing producers, and market manipulation on the global market, in part to provide the backbone for the American petrodollar.

Back in December 2014, the Wall Street Journal wrote in a piece titled, ‘Peak Oil’ Debunked, Again:

The latest reckoning with reality is the end of the obsession with “peak oil,” which for years had serious people proclaiming that we were entering an era of permanent fossil fuels scarcity. It didn’t work out that way.

That’s a central lesson from this year’s dramatic fall in the price of oil, which reached $69.49 a barrel of Brent crude on Thursday from a June high of $112.12. As recently as early November, when oil hovered at $80, OPEC officials warned they would intervene to hold the price at $70. But Saudi officials conspicuously refused to support an output cut at last week’s OPEC meeting, and Saudi oil minister Ali al-Naimi has made clear that he’d be comfortable with lower prices.

The short-term Saudi calculation is to drive oil prices down to squeeze their geopolitical adversaries and higher-cost producers. That goes especially for their adversaries across the Persian Gulf in Iran, which depends on oil exports for over 40% of its revenues, and where the regime had designed its budget based on $100 oil.

The Saudis also hope to slow the explosive growth of U.S. production, which, thanks to the tapping of domestic shale resources through the combination of horizontal drilling and hydraulic fracturing, has risen to some nine million barrels a day from five million in 2008. By some estimates, the price of oil needs to be as high as $90 a barrel for oil extracted from “tight” deposits such as shale, though oil market research firm IHS believes most tight oil wells have a break-even cost of between $50 and $69 dollars a barrel.

Ahead of that story, SHTF warned back in December how falling oil price were being used to ‘cripple’ Russia and push Putin into a posture for war, possibly escalating WWIII.

The Cold War 2.0 is going hot, and while it may someday be fought with planes, tanks, guns and bombs, the first front is being fought with oil and shale gas.

The U.S. and European sanctions against Russia will become more severe and crippling in the face of drastically falling oil prices – prices which are falling drastically because of the unprecedented boom of shale gas fracking both domestically in the U.S. and abroad in Ukraine and other locales. The oil & gas giants like Chevron and Exxon Mobil have created revolutionary conditions with now direct consequences on U.S. foreign policy and global war for dominance. Via Bloomberg:

Oil’s decline is proving to be the worst since the collapse of the financial system in 2008 and threatening to have the same global impact of falling prices three decades ago that led to the Mexican debt crisis and the end of the Soviet Union.

Russia, the world’s largest producer, can no longer rely on the same oil revenues to rescue an economy suffering from European and U.S. sanctions. Iran, also reeling from similar sanctions, will need to reduce subsidies that have partly insulated its growing population. Nigeria, fighting an Islamic insurgency, and Venezuela, crippled by failing political and economic policies, also rank among the biggest losers from the decision by the Organization of Petroleum Exporting Countries last week to let the force of the market determine what some experts say will be the first free-fall in decades.

“This is a big shock in Caracas, it’s a shock in Tehran, it’s a shock in Abuja,” said Daniel Yergin…

The destabilization in Ukraine and numerous spots in the Middle East – including the ISIS-threatened Iraq and Syria – have been mere preludes to what is coming.

How close are we today to that scenario?

0 Comments