This article was contributed by James Davis of Future Money Trends.

The Federal Reserve is becoming the MOST CONTROVERSIAL player in the global stock markets. In the last few days, Jerome Powell’s comments on CONTEMPLATING YCC (Yield Curve Control), which is OPEN MANIPULATION of interest rates, has already managed upset some congressmen even before KICKING OFF THE GROUND, since it’s so un-American.

Jerome Powell has already came up with excuses for using it, such as that it HAS BEEN DONE by the Bank of Japan and the central bank in Australia.

For one, is that even a GOOD PRETENSE? Do we want to be like Japan or Australia? Secondly, where is the point where the FED begins to simplify economics instead of ENTANGLING THE NATION in more monetary experiments?

Courtesy: Zerohedge.com

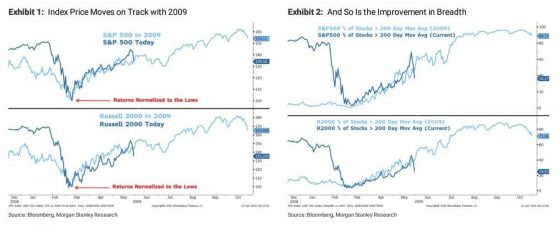

Judging by the market’s action, though, the recovery is clearly in motion. The pricing is much more FORWARD-LOOKING than the real economy, as markets always are, but in this case, it looks like buyers and sellers are agreeing that paying 2023 prices is fair.

In our opinion, the reason why they’re doing that is because investors don’t see other avenues of investment that are as STRATEGICALLY IMPORTANT to the Federal Reserve as the public stock market.

The Federal Reserve rarely intervenes in real estate, as was witnessed during the worst housing meltdown the world has ever known. It didn’t care about the millions of bankruptcies back then – it only worried about SAVING BANKS. If the FED isn’t there to prop it up, it seems investors aren’t that excited about it.

Who says that the economic benefit of bailing out these institutions will bring more prosperity than keeping homeowners from defaulting?

It seems to us that racism is being weaponized as a political tool because this is AN ELECTION YEAR.

I really hope it isn’t, but politicians are made up of some of the most WARPED MINDS in this country and countless LUNATICS IN WASHINGTON will use this genuine struggle to play upon the heightened emotions and swing votes their way.

The fact of the matter is that COVID-19, China, and racism that’s indirectly tied to income/wealth inequality will be the MAIN TOPICS of this presidential campaign.

Courtesy: Zerohedge.com

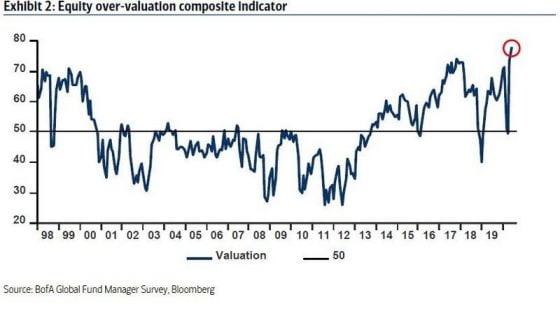

As you can see, Wall Street fund managers can’t CONNECT WITH the notion that valuations will continue to be high as long as the central bank, the STRONGEST ONE on the planet, is inflating prices.

Before we discount and marginalize Warren Buffett, we SHOULD REMEMBER his warning that investors can’t build a portfolio predicated on the premise that ALL FED CHAIRMEN in the future will act like Jerome Powell does.

The point is that when stocks are valued at 20x or 25x earnings, YOU’RE SETTLING FOR very low returns.

Maintaining high levels of cash on the side could prove wiser than you think. I am SHOCKED THAT Berkshire Hathaway wasn’t buying during the MARCH LOWS since there really were attractive companies out there, but my feeling is that as the dust settles and the nation grapples with lingering high unemployment for the next 1-4 years, the excitement towards the stock market will wane and VALUATIONS will TRADE IN A RANGE.

Courtesy: Zerohedge.com

As you can see, there are only two choices: either rates are GOING HIGHER, which the Federal Reserve has already said it WON’T ALLOW by controlling the curve, thus creating inflation, OR stocks are already too expensive and would drop by 10%-15%, as a group.

Since the FED is all about making sure stocks remain elevated, they will be suppressing rates, and we believe that will be the TRIGGER THAT SENDS gold over $2,000/ounce.

Don’t get sidetracked with COVID-19 and its FICTITIOUS second wave; the elections are the most important event to ZERO IN on.

0 Comments