This article was written by Shaun Bradley and originally published at The Anti-Media.org.

Editor’s Comment: This could be the trigger event everyone has been waiting for; it certainly was in 2008. Like the conditioned animal, punished with a shock repeatedly, it produces more fear, and adrenaline and stress response during the build-up from the time the bell is rung and the shock is delivered. The actual shock is actually a relief, even though the animal fears the pain. It will all happen again, once the bell rings.

Here, we know the crash is coming. The banks have orchestrated it, the Federal Reserve is setting the pace and preparing the bed in which we must all lie. A devastating blow to the economy is building up again. Which one will bring it all crashing down, and which will simply prove once again that we are held captive by a dangerous and failing economy that could soon wipe us all out? This could be 2008 all over again; on the other hand, it could be much worse. Either way, there is every sense that things are just getting started.

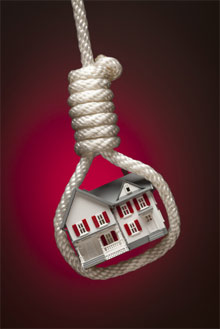

Brace Yourselves, America: The next Huge Housing Bailout Could Be Coming

by Shaun Bradley

The failures of government intervention in the economy have made headlines yet again. Recent stress tests by the Federal Housing Finance Agency found something sinister brewing under the surface at notorious mortgage giants Fannie Mae and Freddie Mac. The results show that these puppet companies could need up to a $126 billion bailout if the economy continues to deteriorate.

That’s right — the two companies that were taken over by the government and that sucked $187 billion from the treasury could be entitled to more taxpayer money. The toxic home loans bought during the last crisis coupled with a lack of liquidity have suddenly become serious risk factors. The so-called “recovery” that has been trumpeted for years by countless politicians and economists is falling apart in plain view. The media will do just about anything to assure the public that this is all isolated and overblown, but the canary in the coal mine has just dropped dead.

The tests ran a scenario eerily similar to warnings we’ve heard about what the economic future might hold:

“The global market shock involves large and immediate changes in asset prices, interest rates, and spreads caused by general market dislocation and uncertainty in the global economy.”

In the throes of the 2008 crisis, the government took many unprecedented actions, but one of the most notable was seizing control of the two largest mortgage loan holders in the country. Since then, Fannie Mae and Freddie Mac have been converted from subsidized private organizations into some of the biggest government-sponsored enterprises ever created. These institutions have been used to prop up the entire real estate market by purchasing trillions of dollars in home loans from other banks to keep prices elevated.

Without Fannie and Freddie, the supply of houses on the market would have far exceeded the number of buyers. This glut in supply and low demand would have forced sellers to lower prices until a deal was made. Instead, these wards of the state were able to buy up properties at artificially high prices using government-issued blank checks, allowing for the manipulation of home values back up to desired levels.

Fannie and Freddie’s main function has always been to buy mortgages from other lenders and clear those liabilities off of the bank’s balance sheets. As a result, the bank is able to lend more money out to the public. For instance, if a home loan is taken out through Wells Fargo, the bank can then sell that contract to a secondary market buyer, like F&F.

The problem facing Fannie Mae and Freddie Mac now is directly connected to the zero percent interest rate policy that has remained unchanged for almost a decade. It has made it harder and harder for loan holders to turn a profit when they can’t earn interest off of the debt they issue. The pressure really started to build in 2012, when the rules of their deal with Uncle Sam changed drastically. Fannie and Freddie were required from then on to pay all profits directly to the treasury, leaving them with very little money for general operations.

As Melvin Watt, director of the Federal Housing Finance Agency, said back in February, “The most serious risk and the one that has the most potential for escalating in the future is the enterprises’ lack of capital.”

The shareholders are still private and have been significantly damaged by the weakness of the companies. Since 2014, both FNMA and FMCC have lost nearly 60% of their stock value. Along with hedge fund, Perry Capital LLC, several investors launched a civil lawsuit against the government in 2013, but it was quickly dismissed by a federal judge. Several appeal attempts have been made, but the government thus far has been unwilling to discuss any form of settlement.

Theodore B. Olson, an attorney representing the shareholders, stated that this new arrangement “systematically drained these entities of all value, leaving in its wake two unsound and insolvent zombies—a golden goose for the Treasury and utterly worthless for the individuals and institutions who in good faith invested in them.”

Although both companies have paid back more than they originally borrowed from the treasury, that money didn’t go towards paying off the nonperforming mortgage debt they bought over the years. As a consequence, they’ve found themselves in an almost identical situation as last time, except with less income and fewer options. This breakdown in confidence is the culmination of over two years of bad economic news and stock price declines.

Anyone who owns a home — or is considering buying one — needs to pay close attention to this developing story. The response from the public, central banks, and legal system will set the tone for how challenges like this are handled throughout the rest of this ongoing crisis. The decisions made in the months to come have the potential to radically impact real estate values across the board. Regardless of the outcome, it seems almost guaranteed that the taxpayer is about to be put through the ringer.

The U.S. and other developed nations are reaching a crossroads. The worldwide suicide pact of government stimulus made during the last downturn has led to a far more dire situation. By blindly granting power to the federal government out of fear, the fate of the American economy was sealed. The State’s track record shows it should have no role meddling in the interests of private companies, or converting their status’ to allow for market manipulation. The bailout plans being put into place — yet again — for Fannie and Freddie will only compound the problems.

The same government that has mismanaged and extorted billions from these enterprises for almost a decade should not be the one we turn to for help. The federal government has proved its incompetence time and time again, and the taxpayer continues to be punished for it.

It’s always tempting to trust someone else to come up with solutions that protect your future, but unfortunately, this massive fraud has left us in a no-win situation. If the past isn’t reflected upon and learned from, the entire global economy is going to get a lot worse before it gets better. When the moment comes to take a stand on these pressing issues, only those who have educated themselves will have a meaningful voice. The power of one informed individual is unmatched by any level of propaganda.

This article was written by Shaun Bradley and originally published at The Anti-Media.org.

0 Comments