Former Chairman of Princeton Economics International and Foundation for the Study of Cycles, Martin Armstrong, discusses his 78 Year Real Estate Cycle Wave. Armstrong provides readers with a brief look at real estate by superimposing his model throughout history dating back to Athens and Julius Caesar, through 2009 and beyond.

“There is no delicate way to put this right now, but we are looking at a serious economic depression in terms of values of real estate. We have reached a crossroad that is very profound and if we do not at least try to comprehend the problem, we may be facing the worst economic implosion that has taken place in centuries. Thanks to the New York Investment Banks, they helped to leverage real estate far beyond anything that took place in history, and we are going to pay the price.”

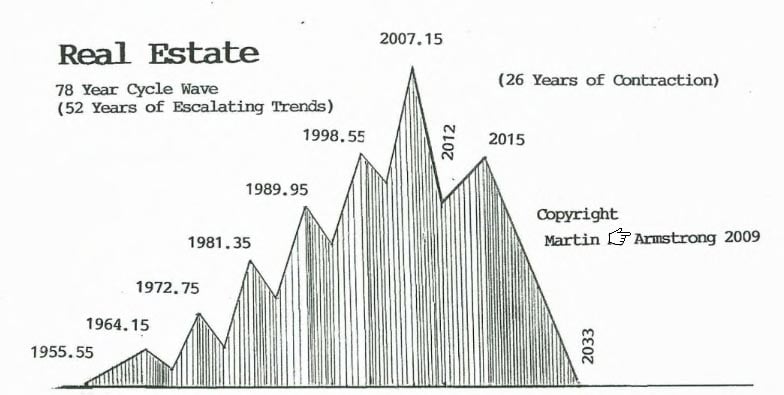

The following 78 Year Real Estate Cycle Wave shows the major turning points for real estate through 2033. Note the 2007.15 turning point as being the top of a 52 year rise. According to Armstrong, the following 26 years will see a decline in real estate prices through 2033, with a brief rise from 2012 through 2015.

(Click for larger image)

Martin Armstrong discusses the presumption that real estate always rises:

“The FIRST golden rule, “Presume Nothing” is so profound, far too many people just go charging forward. It has been the presumption since my childhood, that real estate always rises in the long-term and thus is a great asset constituting the majority of the average person’s wealth.

What if the presumption is wrong?

Now we are entering into a subject-matter that is so fundamental, it starts to get a bit scary. You will now see what IÂ have been very concerned about after discovering this serious problem decades ago.

I have written about the Debt Crisis that was faced in Athens by Solon (630-530BC) and Julius Caesar (100-44BC). Now these history lessons will start to pay-off. What was it causing the debt crisis? Real Estate! This is critical to understand. It was not the public debt alone, but the private debt involving REAL ESTATE!”

As we’ve discussed in prior posts, this is the largest collapse of debt the world has ever seen, and it has been caused, in major part, by real estate debt. As Martin Armstrong points out, real estate driven debt collapses are violent and volatile. And, if history is any guide, this could very well threaten the foundations of These United States.

Read the full article by Martin Armstrong: A Forecast for Real Estate:

Related Reading:

0 Comments