This article was originally published by Tyler Durden at ZeroHedge.

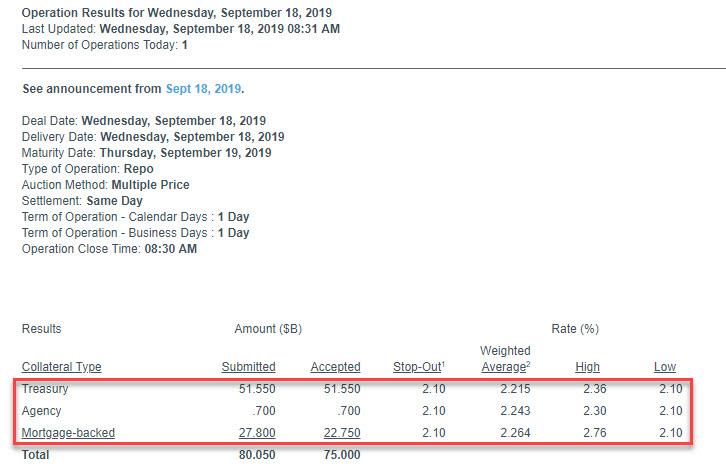

20 minutes after today’s repo operation began, it concluded and there was some bad news in it: as we feared, yesterday’s take-up of the Fed’s repo operation which peaked at $53.2 billion has expanded substantially, and according to the Fed, today there was a whopping $80.05BN in bids submitted, an increase of $27 billion, or 50% more than yesterday.

It also meant that since the operation – which is capped at $75BN – was oversubscribed by over $5BN, that there were one or more participants who did not get up to €5 billion in the critical liquidity they needed, and that the Fed will see a chorus of demands by everyone (because like with the discount window, nobody will dare to be singled out) to either expand the size of its operations, implement a fixed operation and/or – most likely as per the ICAP note yesterday – transition to permanent open market operations, i.e. QE

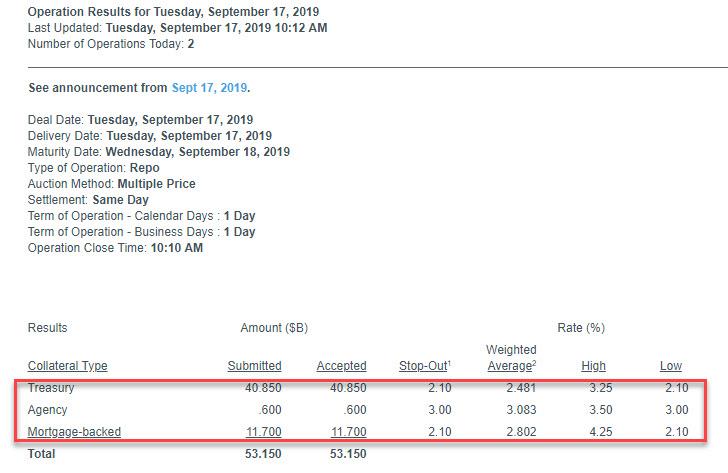

By comparison, this is what yesterday’s repo operation looked like:

What is immediately notable is that except for agency paper, there was greater use of both Treasury ($40.9BN to $51.6BN) and Mortgage-backed ($11.7BN to $27.8BN) collateral. The only silver lining: the step out rate on agency paper dropped from 3.00% to 2.1% however with virtually nobody using that, it is a largely meaningless easing in terms.

Finally, the worst news is that immediately after the operation, overnight repo remained elevated, with Reuters reporting the rate was 2.25%-2.60% after the latest repo operation, confirming that the liquidity shortage continues with the high end of repo still far above fed funds.

Yesterday’s Fed repo operation – the first direct liquidity injection in a decade – was an unmitigated disaster, with the NY Fed forced to cancel it in the middle due to “technical difficulties” which nobody still knows what they were, only to resume it moments later. All we can say is that today the Fed better not fuck this up again, especially with New York Fed President John Williams, senior vice president of market operations Lorie Logan and first vice president Michael Strine all expected to be in Washington for the Fed’s two-day central bank meeting.

In any case, moments ago the NY Fed announced that, as expected, today’s repo operation started at 8:14 am as expected, with the repo rate trading quite elevated around 2.80% and the SOFR trading bizarrely above 5%

- Overnight U.S. Funding Rate at 2.8%, Elevated for a Third Day

- *SECURED OVERNIGHT FINANCING RATE JUMPS TO 5.25%

With such mindboggling volatility, SOFR will certainly make a “great” LIBOR replacement.

Check back here at 830 am ET for the results; it will be interesting if the total uptake today is over yesterday’s $53BN – that will suggest that the problem is getting worse, not better…

0 Comments