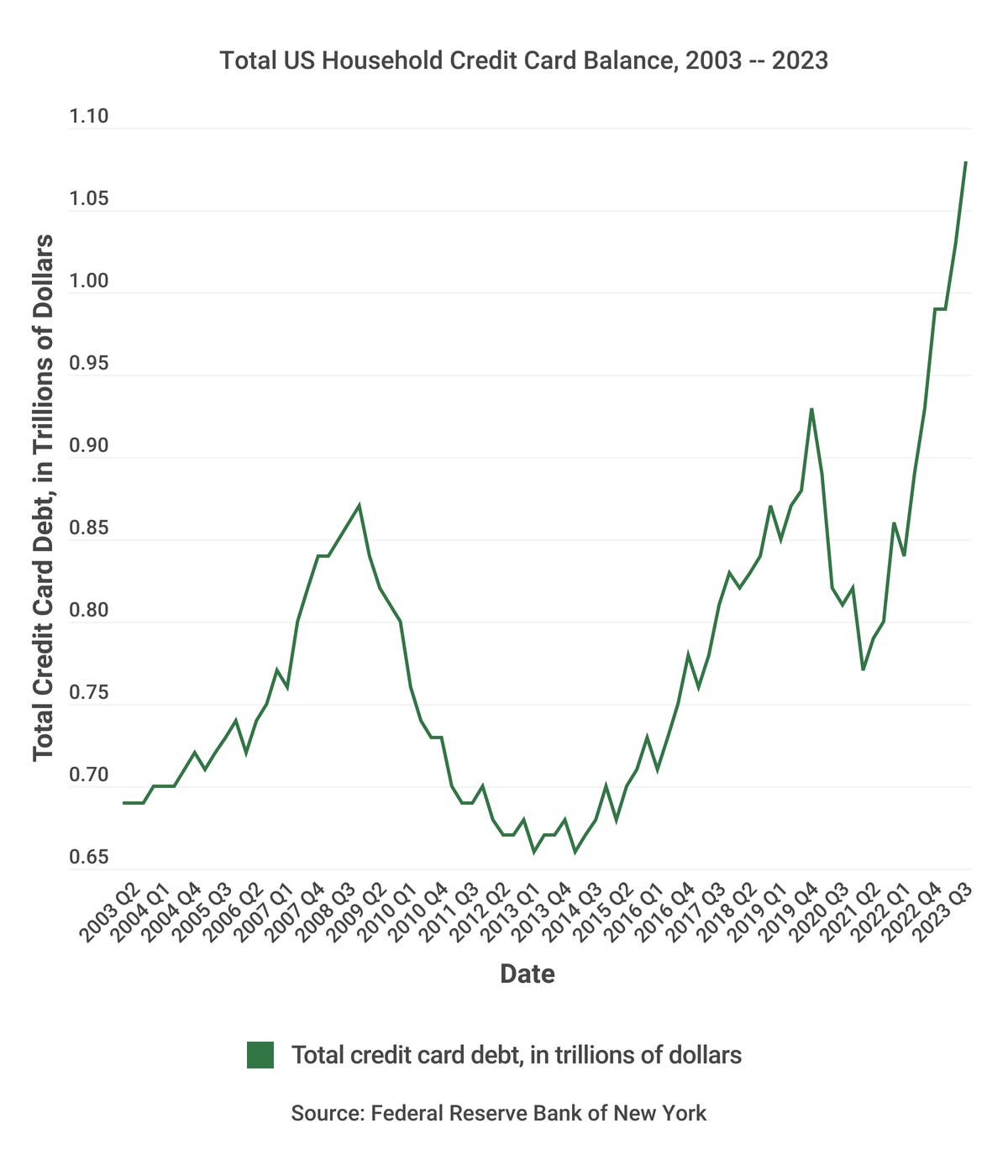

Americans are largely maxed out when it comes to the amount of debt they have accumulated. Americans had surpassed a combined total of over $1 trillion in credit card debt back in August. Three months later, the balance had already gone up an additional $48 billion.

The August data came from the Federal Reserve Bank of New York released its Household Debt and Credit Report for the second quarter of 2023 and it continues to worsen as Americans struggle under the weight of an oppressive ruling class and central bankers. According to CNET, what’s more alarming is that the cost of carrying this debt has also increased. Credit card APRs have gone up 30% in the last year and a half, eating away at consumers’ budgets more than ever before.

How the Government is Causing a Credit Card Debt Crisis

Credit card debt is just one type of debt we face in our lifetimes, along with mortgages, car loans, student loans, and medical debt. But the credit card is uniquely powerful. It’s comparatively easy to obtain. It’s aggressively marketed. It also heavily influences your credit score, the financial reputation marker that determines if and how you fund future milestone purchases.

Credit can be a lifeline for many in hard times, but it can also be quietly destructive. As the pace of inflation surpasses wage growth, it’s gotten harder to afford rent, utilities and groceries, forcing us to rely more on credit cards for everyday goods. –CNET

Americans Falling Behind on Credit Card and Loan Payments as Inflation Persists

People are being pushed to the brink of financial ruin as the ruling class continues to print more fiat currency to fund wars on the other side of the globe. All this is happening as consumerism and consumption rates rise in the United States.

We Have Become An Extremely Gluttonous Society That Consumes Far More Than It Produces

Consumer Credit Is Expanding Even While the Fed Pushes up Interest Rates

When this house of cards comes crashing down, it’s going to be very painful for the majority of the population.

0 Comments