|

|

|

|

||

“Right now I have no shorts because they are printing so much money. The Dow could reach 30,000 but it would be in worthless money.” – Jim Rogers

“There’s a 40%-50% chance the market will crash right through the bear-market lows set last spring.” – Gary Shilling

Bulls vs Bears. So who do we believe, Rogers or Shilling? Are we headed for chronic, Japanese-style deflation or Zimbabwe-style hyperinflation? Is the market going to triple soon due to money printing or is it going to fall through the floor set in March 2009 because of a loss of confidence in the US economy? Why is there so much confusion on this topic? Why are we being given such drastically opposing views by the so-called experts? Why does it seem that we are being forced into a position where if we guess wrong we could lose everything? In this report I am going to attempt to cut through some of the BS that we are being fed right now on both sides of the argument and give you my take on the situation. But first, lets take a look at the information we have and try to break it down.

WARNING SIGNS

Recent Trends and Headlines. We are getting ready to enter the dreaded 4th quarter, during which most major stock market crashes have unfolded (1929, 1987 and most recently 2008) and during which, even in a healthy economy, the market tends to underperform. Government debt is mounting while unemployment continues to rise. The effects of the stimulus packages are beginning to wind down. Barack Obama himself has admitted that he is running out of options because intererst rates can’t get any lower than zero. There is talk of yet another stimulus package as if it is almost an inevitability. Home sales are making new lows practically every month. In short, the tide is retreating once again and it is revealing just how weak our economy really is. Precious Metals. Those who have invested in gold and silver may be getting happier nowadays, but that usually means that things are generally getting worse for most people. As Peter Schiff predicted, precious metals have begun to decouple from their traditional inverse relationship with the dollar, which means that people are no longer running to the dollar as a safe haven. Metals seem to go up regardless of what the market does. If both stocks and the dollar go down as gold and silver go up that can only mean one thing: more people are beginning to realize that gold and silver are the true safe havens of our time. Small Banks – The True Indicator of America’s Economic Health †. ElizabethWarren, Chair of the Congressional Oversight Panel, in her July 2010 report talks about how TARP apparently seemed to work out much better for the big corporate banks than it did for the small banks in this country. Whether or not this was by design is an important question to ask, however I don’t want to focus on that aspect of it right now. Regardless of the reason, the playing field is clearly lopsided against the small banks. In her report, Warren offers some disturbing statistics. “Of the big banks that received capital purchase progam money, 76% have already repaid. Of the small banks, less than 10% have repaid. In fact, 15% of the small banks have already missed a dividend payment [to the US Treasury (which is technically a TARP repayment default)].”So small banks are continuing to fail at a record pace while big banks are buying them up. One of the reasons for this is that many of these small banks have incredible exposure to commercial real estate which is crashing and burning as I type this. Warren then concludes “If TARP ends up saving big banks but leaving small banks to be swallowed up or to collapse then its legacy could be an even more concentrated and possibly more vulnerable financial system.”In short, unless we want to keep our money under our mattresses, soon our only banking options may be Wells Fargo,Citigroup, JP Morgan Chase and Bank of America, all 4 of which the government has already shown that they will never let fail. Corporatocracy 1, Capitalism 0.

OMENS

The Hindenburg Omen. There are many “indicators” in the stock market: moving averages, 52 week highs and lows, bearish sentiment, bullish sentiment, technical patterns, P/E ratios, buy signals, sell signals, etc., but none are supposed to be as scary as the Hindenburg Omen. What is a Hindenburg Omen and what is it supposed to mean? If the following 4 criteria are met, there is supposedly a very good chance we will see a significant drop in the market shortly thereafter. Here are the 4 criteria: 1. The daily number of New York Stock Exchange new 52 week highs and the daily number of new 52 week lows are both greater than or equal to 2.8 percent (typically, 84) of the sum of NYSE issues that advance or decline that day (typically, around 3000). 2. The NYSE index is greater in value than it was 50 trading days ago. 3. The McClellan Oscillator is negative on the same day. 4. New 52 week highs cannot be more than twice the new 52 week lows (though new 52 week lows may be more than double new highs). Does this sound like a bunch of technical nonsense to you? Me too. I mean, why should these 4 things mean that the market is getting ready to implode? Do they have anything to do with jobs? Do they have anything to do with investor confidence? No. One thing you can’t dispute, however, is that “The Omen” has a 77% accuracy rate of predicting stock market slumps of at least 5% within about 5 weeks of its occurrence, and guess what folks – we just got one on August 12th. The Bright Side. A 77% accuracy rating means that 23% of the time nothing happens. Also, and most importantly, this has to be the best advertised Hindenburg Omen that has ever occurred. Just ask Glenn Beck. He did a whole segment on his show about it on August 16th. Since then, all you have to do is type “Hindenburg” into your google search bar and “Hindenburg Omen” is the 2nd or 3rd choice that appears (I guarantee you this was not the case before Mr. Beck called everyone’s attention to this phenomenon). In other words, a lot of people know about this now, and if you consider yourself a contrarian like me then you live by the creed that “the herd is usually wrong”. Besides, what are omens anyway? Aren’t they supposed to be things like black cats walking in front of us and shooting stars confirming that our wishes will come true and whatnot? Omens simply appeal to our superstitions because they supposedly have a high correlation with certain events happening, but they do not represent true causation whatsoever and must be taken with a grain of salt. In my opinion, if you are going to take all of your money out of the stock market do it because you believe the fundamentals for a bullish market are simply not there. But don’t do it because Glenn Beck says that God told him the market was going to drop 5%. What if it drops 5% in a matter of days and then bounces back up just as quickly? What is your plan for gettng back into the market? All I’m saying is to not base your decsion on what to do with your life savings because of something like the Hindenburg Omen.

PREDICTIONS

Given these warning signs and “omens” and what the government has already shown us what they plan on doing to try and keep asset markets afloat, let’s look in more detail at some of the predictions that are being made by both the bulls and the bears: Deflationist Predictions – Panic Selling and Stocks to reach 38 Year Lows. Some bears are actually calling for Dow Jones 1,000 followed by a sustained deflationary depression that will last several years. This would be a nominal decline back to October of 1972 when the Dow hit quadruple digits for the first time in history. In this scenario, cash and government bonds are the place to be because they will gain purchasing power as prices all over the world fall. Safety will be the name of the game. Gary Shilling, Mish Shedlock and a few others believe that most asset markets are getting ready to plunge so you should sell everything including gold and silver which have been in a bull run for the past 10 years. Some bears predict gold to fall as far as $100 an ounce, and silver… well, let’s just say that the 1964 quarters (which contain about 92% silver) technically won’t be worth thier face value at that point, but at least we’ll be able to spend them as if they were. All of this supposedly will happen despite governments around the world printing money like there is no tomorrow in order to try and avoid this very scenario. And government bonds, which have already enjoyed a 29 year rally, will continue to be the best investment for several more years to come. Inflationist Predictions – Hyperinflation and Stocks to Reach Astronomical Levels. Jim Rogers is not the only one calling for the Dow Jones to triple, however he never said it was going to happen tomorrow. In fact, most inflationists (including Marc Faber) agree that hyperinflation is inevitable in the US but is not likely for at least another 5 years. In the mean time, could we see the market drop 5% or more? Of course. But, the real question is: could a drop in the market like this trigger another panic-driven capitulation that causes the market to crash through the March 2009 lows? Faber says no. In his appearance on Bloomberg Television on August 29th (2 days after Bernanke’s speech in Jackson Hole, Wyoming in which he announced that the Fed is prepared to print as much money as necessary in order to create jobs) Faber says “The market, in my opinion, will perceive [quantitative] easing moves by central banks around the world as being inflationary for asset markets.” In other words, at least some (if not most) of the money will flow into the stock market and commodities. Therefore, Faber does not believe we can reach the March 2009 market lows again.

FINAL THOUGHTS

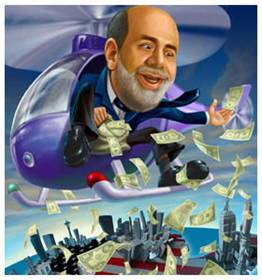

Why Hasn’t the Market Crashed Yet? One thing is for sure, our economy is not healthy. You don’t need to be an expert to know this. You just need to turn on the news. Among other things, the stock market is supposed to be one of the indicators of the strength of our economy. That is not all the stock market represents, however, because if it was I believe that we would be at Dow Jones 5,000 (or possibly lower) right now. The stock market also reflects where people feel safe keeping their money. For example, if you think hyperinflation is on the way would you rather be in cash or stocks? And if you think higher interest rates are on the way would you rather be in government bonds or stocks? Therefore, the stock market, for many people. just represents the greater of the available evils right now. After all, when stocks plunged in the 4th quarter of 2008, they did bounce rather significantly off the March 2009 lows for an extended period of time, so much has happened in the past year and a half to restore general confidence in the market. Sheep in a Burning Barn. So why would people run back into the market after getting burned so bad? This is because sheep don’t usually have the sense to run out of a burning barn. Instead, they will typically run from a hotter part to a cooler part or a smoke-filled part to a non-smoke-filled part, but to leave the barn itself is to them the greatest risk of all, because the security of the barn is all they know. Put this in the context of the average investor. The last thought on most people’s minds is to abandon stocks, bonds, AND cash and to invest in gold and silver. This unchartered territory is so out of most people’s comfort zones that it represents the biggest risk of all. Furthermore, do you think their brokers are telling them to sell everything and to get into precious metals? But when the herd finally does come rushing into precious metals (which will happen), it will be an incredible thing to watch. Here’s my 2 cents. Take it for what it’s worth. We have had periods of both deflation and inflation in this country, however in the end inflation has always won. Why is this? It is because of one reason: The Federal Reserve. Since their creation in 1913 they have succeeded in devaluing the dollar by 95% – and guess what folks, they’re still in power. As long as they’re calling the shots I believe the trend will continue. Forgive me for indulging myself a little by quoting one of my favorite movie characters of all time, Michael Corleone. Remember in The Godfather Part 2 when Michael’s then wife Kay was threatening to leave him and take his children? I see a similar scenario playing out right now where the stock market is threatening Ben Bernanke with a deflationary depression. In both scenarios these men, having equal amounts of vigor and passion for what the believe, have the same answer:

“Don’t you know that I would use all of my power to prevent something like that from happening?”

|

|

Bye for now, Schaef

The Schaef Report is an independent newsletter contributed to SHTFplan.com by Mr. A Schaef. You can receive the Schaef Report in your inbox. It’s Free! Subscribe below by providing your name and email address and you’ll be automatically added to the monthly distribution list. The Schaef Report and SHTFplan.com take your privacy very seriously and will not distribute or share your email address with other parties. [contact-form 3 “Schaef Newsletter Contact Form”]

0 Comments