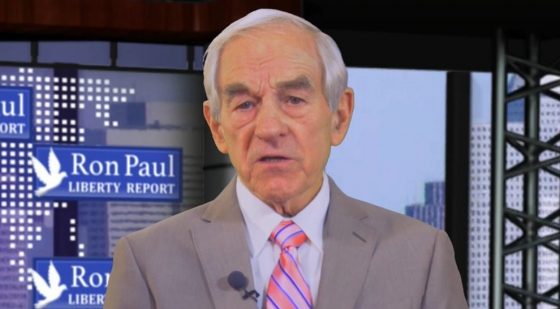

Ron Paul is sounding the same alarms as veteran financial investor Peter Schiff. The former presidential candidate has warned that the current stock market is the “biggest bubble in history and it is going to burst.”

The market is in the “biggest bubble in the history of mankind,” and when it bursts, it could cut the stock market in half, he recently told CNBC. “I see trouble ahead, and it originates with too much debt, too much spending,” the former Republican Congressman from Texas said. However, since Paul leans libertarian in political philosophy, he sees that one of the major problems with the market is federal spending and monetary policy which act as dual forces inflating a market bubble.

“The Congress spending and the Federal Reserve manipulation of monetary policy and interest rates — debt is too big, the current account is in bad shape, foreign debt is bad and it’s not going to change,” he said according to Newsweek. “The Fed will keep inflating, and that distorts things,” Paul continued. “Now they’re trying to unwind their balance sheet. I don’t think they’re going to get real far on that. The government will keep spending, and the Fed will keep inflating, and that distorts things,” said Paul. “When you get into a situation like this, the debt has to be eliminated. You have to liquidate the debt and the malinvestment.”

But the government isn’t interested in liquidating any debt or allowing the free market to take control, so we have the biggest bubble in history and it could burst anytime, and the media won’t report on the dangers of the financial situation the government is in. Newsweek reported that the U.S. economy is growing at a 4.5 percent annualized rate in the second quarter following the latest data on strong retail-sales data, the Atlanta Federal Reserve’s GDPNow forecast model showed on Monday.

However, Dr. Paul is not alone in his assessment. Peter Schiff has said numerous times that the state of the economy is far from what the talking heads in the media declare it to be. A lot of seemingly positive economic data came out in early June, but in his most recent podcast, Peter Schiff said it is just feeding into a delusional economic narrative which simply ignores the most fundamental storyline – debt. According to Seeking Alpha, Schiff says that this delusion built on debt is not going to last, and we should all be prepared.

0 Comments