This article was originally published by Tom Beck at Portfolio Wealth Global.

For three weeks, we’ve been explaining HOW CRUCIAL it is not to be PARALYZED BY the incessant fear and drama of those who are comparing 2020 with 1929 – it really isn’t.

There are REAL FORCES in motion, both in China and the USA, the two largest economies, which are GROWTH-ORIENTED.

Courtesy: Zerohedge.com

People are just NOT DOING their homework; the recovery is underway from this not-so-bad pandemic. The FORCE OF INERTIA behind this willingness to STAND FIRM and live with the disease is great; the masses do not want to be quarantined a SECOND TIME.

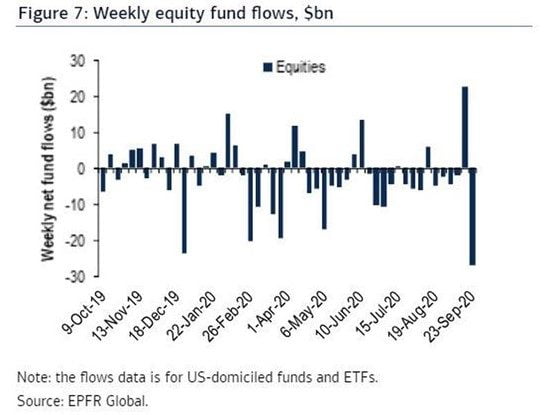

The fact of the matter is that we’re seeing an INSANE AMOUNT of selling and the only reason is that there’s an election in the pipeline; it’s not the second wave that is spooking markets. I want to remind everyone that the ECONOMIC MACHINE is bigger than any one president and it’s bigger than any one administration.

Entrepreneurs ADAPT; they adjust to trade wars, tariffs, taxes, interest rates, worker unions – they can PRETTY MUCH absorb all shocks. Just about the ONLY THING they can’t do is face DRACONIAN LAWS, but we’re not there yet…

Courtesy: Zerohedge.com

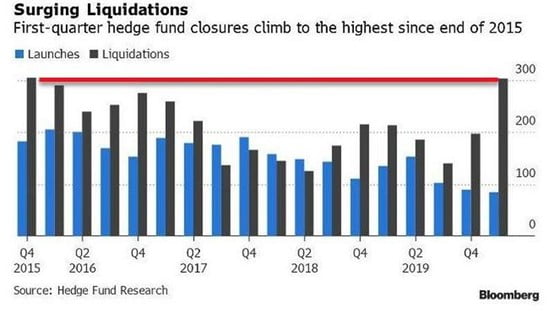

Judging by the number of hedge funds closing their doors, we believe this is a HUGE MISCONCEPTION on the part of the value-investing veterans, who equate this to a bubble.

In a world where $13tn is STUCK IN NEGATIVE-yielding bonds, there’s so much MORE UPSIDE for businesses, stocks, commodities, and just about anything!

I implore you to realize that the bubble is in GOVERNMENT DEBT and that the rest is PEANUTS compared to that.

Today, a presidential debate is happening and afterward, the world of investing will have MORE CLARITY on the identity of the leader of the free world in the next four years, but don’t think that STOCKS WILL crash or surge, solely due to that.

I’m positively convinced that a recovery is well IN MOTION and that the level of breakthrough innovation that’s occurring is UNDERESTIMATED.

Stay LONG; it’s the natural position to be in.

0 Comments