This article was contributed by Tom Beck of Portfolio Wealth Global.

There’s nothing like a close race to get the JUICES FLOWING. Fake polls or not, Trump knows that he is losing public support and that he might be close to losing the upcoming election. Before the virus, it was NEXT TO GUARANTEED that he’d win and stay for a second term.

I wouldn’t exactly call him an underdog, but it’s MUCH TIGHTER than it would have been without Coronavirus.

The most important FORWARD-LOOKING market anticipation right now is that the dollar is entering a long bear market.

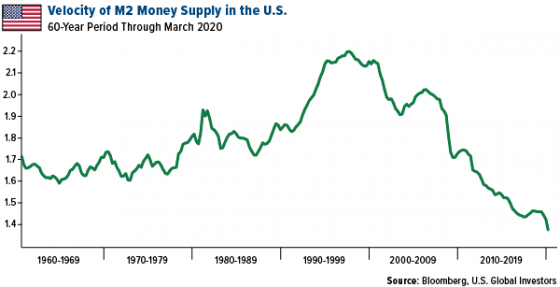

Check this out:

Courtesy: U.S. Global Investors

What this shows you is that the ODDS OF INFLATION increasing are huge!

Basically, money isn’t moving now; the public has stopped spending and wealthy individuals are scared of making big moves. EVERYTHING IS IDLE. The race between Biden and Trump makes large institutions paralyzed until they know the answer.

Well, after idleness in velocity, there’s only one option: MULTIPLIER EFFECT.

The real economy is hurting and it will take 2-3 years, perhaps even four years, to get back to where we were.

The thing is that Europe looks more united on its goals than even the United States does.

This is the first time since 2008 that EU political leaders have more in common with each other than American politicians do with their counterparts in the opposing party.

The Euro is more attractive than the dollar since European companies are cheap.

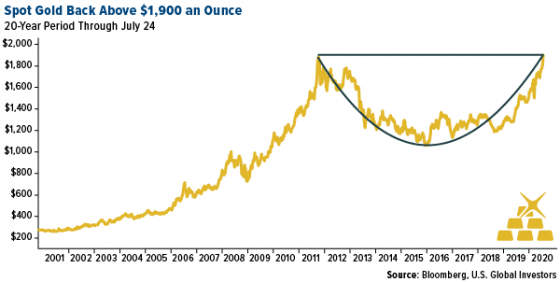

Courtesy: U.S. Global Investors

When the dollar is OUT OF FAVOR, as it is becoming at present, then gold’s price can triple, beginning with the MONETARY U-TURN in January 2019.

In other words, we’re putting a 2-year price target of $3,300/ounce on gold. We anticipate this occurring by July 2022.

The elections will force Trump to get aggressive on policy in the coming months, and I believe that he is desperate not to allow Covid-19 to define his so-called “legacy.”

In his eyes, he has been the greatest president ever, so he can’t let a pandemic defeat him. Therefore, with the dollar now at 52-week lows, our analysis is that the election battle will cause a DOLLAR CRISIS.

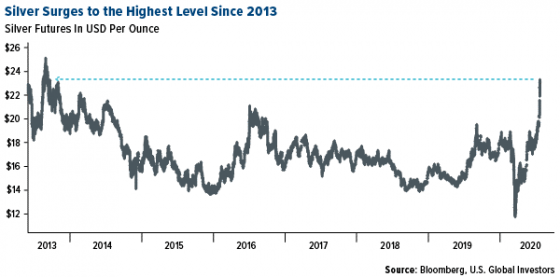

Courtesy: U.S. Global Investors

As you can see, the next REAL HURDLE for silver is $25/ounce, which it should clinch in the coming weeks.

It has incredible momentum.

The banking system is saturated with money; Judy Shelton has cleared the banking committee and she will most likely pass the vote in the REPUBLICAN-LED Senate. This will give America a SOUND MONEY advocate on the board of the Federal Reserve.

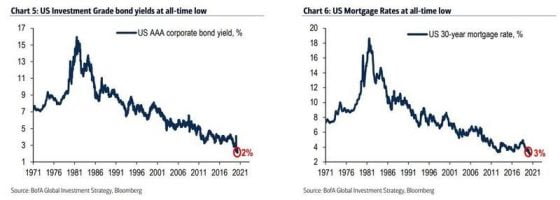

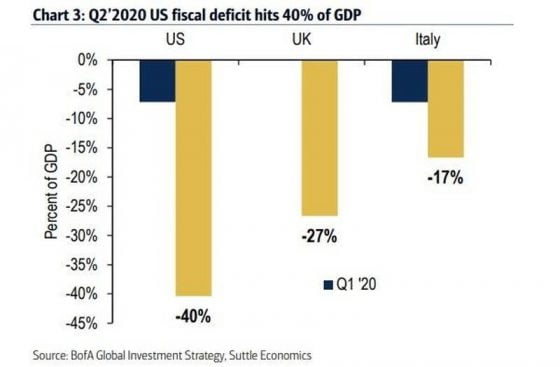

Courtesy: Zerohedge.com

The incentives to BORROW MONEY today will soon bring households back to the fold. They won’t be able to resist the low rates. I am telling you that you MUST PREPARE for a dollar bear market and an amazing precious metals BULL MARKET.

Trump will have to divert the public attention BACK TO CHINA; he will do it subtly so that markets don’t panic, but nonetheless, he must unite voters against a common enemy and we believe he will.

You can’t change or fight the trends: GOLD AND SILVER are headed MUCH HIGHER!

Courtesy: Zerohedge.com

0 Comments