This article was contributed by Tom Beck of Portfolio Wealth Global.

Retail investors are SIGNING their own DEATH WARRANT right now.

On every GREEN DAY, they’re doubling down and on each BLOODY RED SCREEN, they’re buying the dip.

I was 16 when the Dotcom niche was raging and I remember that EVERYONE was talking about it, but I didn’t get to FEEL IT. In 2017, I was seeing it FIRST-HAND with cryptocurrencies. Right now, it smells like we’re in the midst of the bubble TOWARDS THE END.

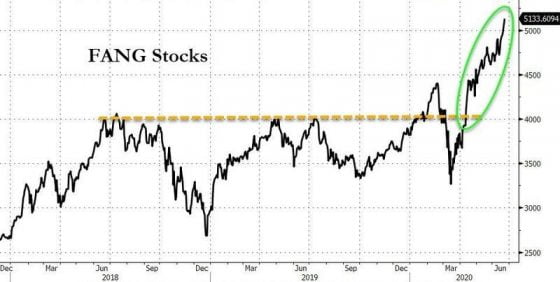

Courtesy: Zerohedge.com

As much as we are all aware that Facebook, Apple, Amazon, Microsoft, and Netflix are the HEDGE FUND DARLINGS and that nothing lasts forever, we can’t FIGHT TRENDS.

When huge paradigm shifts occur, the darlings change.

For now, as you can see, the trend is still in place, which tells me the BULL MARKET is still on.

It’s the LAST STRETCH of the euphoria, so the indices will be volatile. It’s normal, and you have to decide if you just WANT TO OBSERVE or time this mania and capitalize.

We STRICTLY FOLLOW our watch lists and LIMIT ORDERS, available HERE and HERE.

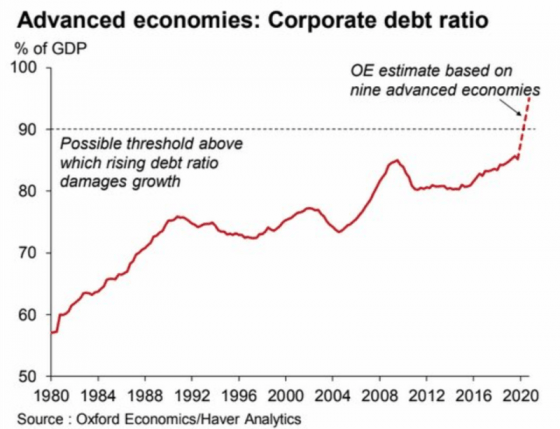

Courtesy: Zerohedge.com

One of the sub-prime mortgage crisis’ most famous CEO quotes was that you have to keep dancing as long as the music is playing, and CEOs are certainly TAKING FULL ADVANTAGE of the appetite out there to lend funds at STUPIDLY-LOW rates to corporations.

Too much money at the hands of the rich and they have run out of places to put it. This is the main driver of artificially-low rates for corporate bonds.

So what’s next? More of the same, but make sure to keep an eye on gold since $1,800/ounce is a BIG DEAL for it.

The IMF (International Monetary Fund), which is a SYSTEMATICALLY IMPORTANT institution, is warning off investors about the recession and the market-high valuations.

I’ve never seen this institution so bearish.

On the flip-side, retail investors are so bullish that they are BASHING Warren Buffett for selling the airlines, Howard Marks for advocating caution, and they’re celebrating how easy it is TO PICK WINNERS.

This is how a bubble looks close to the end; newbie traders feel invincible.

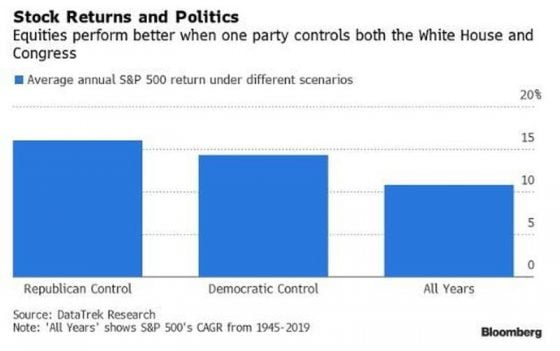

Courtesy: Zerohedge.com

As you can see, the elections will DETERMINE much for the stock market in the coming years.

Don’t buy the whole notion that markets will crash JUST BECAUSE Democrats are in charge, but as I said on Tuesday, I just don’t place ANY VALUE on Joe Biden, specifically.

In the next few days, perhaps over the weekend even, we will know if some states will go back to COVID-19 restrictions.

The markets have been pricing in a recovery without ANY STALLS, so any real bad news will lead to a SELL-OFF, while any good news, to the contrary, will drive investors back.

Expect plenty of ups and downs in the weeks ahead!

As far as we’re concerned, the entire system is at its most delicate phase since 1971.

It wouldn’t take a storm to drive it to the ground – a MILD SNEEZE will do!

0 Comments